Nearly a decade and a half after the Fukushima Daiichi nuclear disaster prompted a nationwide shutdown of its atomic energy program, Japan is signaling a profound shift in its national energy strategy with the restart of the Kashiwazaki-Kariwa nuclear power plant. This facility, the largest of its

Beneath the surface of Pennsylvania’s rolling hills and historic landscapes, a silent and insidious crisis is unfolding within the state's waterways, which serve as the lifeblood for millions of residents. The source of this new threat is a massive and continuous stream of toxic, and often

A complex geopolitical ballet is unfolding as a Saudi Arabian energy firm attempts to acquire the sprawling $22 billion global empire of a sanctioned Russian oil giant, placing the decision squarely in the hands of U.S. regulators. At the center is Midad Energy, a Saudi firm whose success or

The global energy market has been sent reeling as oil prices plunged to their lowest point since February 2021, a dramatic downturn driven by the powerful confluence of burgeoning supply and rapidly deteriorating global demand. This sharp decline, which saw Brent crude futures fall below the

A leadership carousel spinning at an unprecedented rate for an energy supermajor often signals deep-seated turmoil, yet at BP, the appointment of a fourth CEO in six years suggests a calculated and aggressive doubling down on its fossil fuel origins. The selection of Woodside Energy’s Meg O’Neill

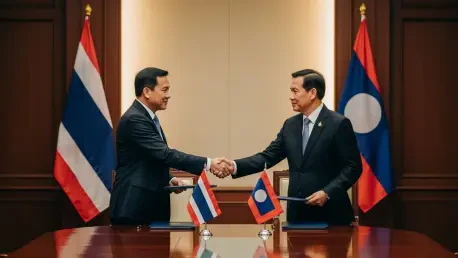

A sudden spike in fuel truck traffic at a key border crossing recently ignited security concerns and diplomatic friction between Thailand and Laos, raising questions about illicit trade networks operating in Southeast Asia. The situation, centered around allegations that Laos was serving as a