What drives a global energy giant to soar in production while stumbling in trading? In the volatile world of oil and gas, BP's third-quarter results for this year paint a striking picture of contrasts—robust growth in upstream output paired with unexpected drags from weaker oil trading. This

What happens when a nation's energy lifeline is squeezed by global powers? In the heart of the Balkans, Serbia faces a daunting challenge as U.S. sanctions target Naftna Industrija Srbije (NIS), the country's primary oil company, majority-owned by Russia's Gazpromneft. With energy security hanging

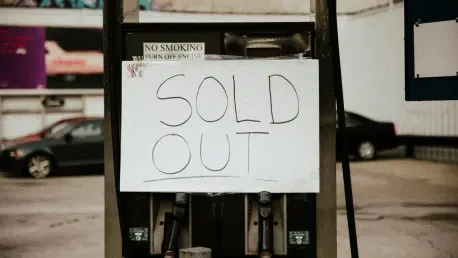

Setting the Stage for a Shifting Oil Landscape Imagine a global energy market teetering on the edge of transformation, where every barrel of oil produced could tip the balance between scarcity and surplus, and in 2025, the Organization of the Petroleum Exporting Countries (OPEC) and its allies,

Recent developments in international trade have brought to light a critical issue as new U.S. sanctions on Iranian petroleum exports target a key crude oil terminal in China, directly affecting Sinopec, the nation’s largest refining company. These sanctions, announced in a bold move by Washington,

What happens when a titan of the oil industry, already a powerhouse in global energy markets, doubles down on expansion with a $55 billion gamble? Chevron, the second-largest U.S. oil producer, has set the stage for a high-stakes drama with its acquisition of Hess, a deal that promises vast

Imagine a landscape where U.S. oil production soars to unprecedented heights, breaking records with every barrel pumped, yet the global market drowns in oversupply, dragging prices to alarming lows, creating a paradox that defines the current energy sector. This reality pits domestic triumphs