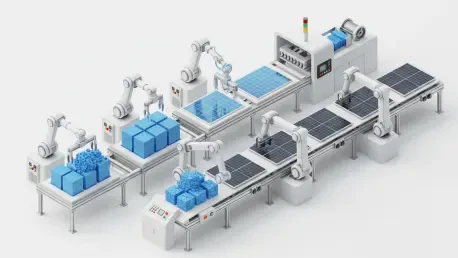

After years of ambitious effort and strategic investment, the American solar industry has achieved a landmark goal, successfully reshoring every critical stage of its manufacturing supply chain from raw material processing to final module assembly. This monumental accomplishment has ignited a period of unprecedented domestic growth, with U.S. solar production surging by 37% since 2024 and domestic module production capacity now soaring past the 60-gigawatt threshold. This manufacturing renaissance is not merely a statistical victory; it represents a foundational shift toward enhanced energy independence and significant economic expansion through the creation of thousands of high-skilled jobs. However, this period of triumph is now shadowed by a growing sense of unease, as a new report from the Solar Energy Industries Association (SEIA) warns that recent administrative actions are injecting a destabilizing level of uncertainty into the market, threatening to halt the industry’s hard-won momentum in its tracks.

A Domestic Manufacturing Renaissance at a Crossroads

The successful onshoring of the solar supply chain has been a powerful engine for the nation’s economy, directly translating into new factories and a burgeoning workforce dedicated to clean energy. This domestic industrial base provides a critical buffer against global supply chain disruptions and geopolitical volatility, strengthening national energy security by reducing reliance on foreign imports. This increased self-sufficiency has arrived at a pivotal moment, as American homeowners and businesses are increasingly turning to solar installations to mitigate the impact of rising utility prices and actively reduce their carbon footprint. The industry has demonstrated its capacity to meet this escalating demand with American-made products, fostering a virtuous cycle of domestic production and consumption. Yet, the entire framework of this success story rests upon a stable and predictable investment climate, a foundation that industry leaders now see as being actively eroded by shifting policy winds.

The concerns voiced by industry experts have coalesced into a stark warning about the future. According to SEIA president and CEO Abigail Ross Hopper, recent policy developments are creating significant market uncertainty that could undermine the very progress they were designed to support. This precarious environment threatens to jeopardize the next wave of planned factory investments, as companies become hesitant to commit billions of dollars without clear, long-term policy support. The potential consequences are cascading, from stifling job creation in the manufacturing sector to causing energy costs to rise for consumers if domestic supply falters. Ultimately, experts fear that this instability could drive investment overseas, effectively ceding America’s newly established manufacturing advantage to global competitors and reversing the crucial gains made in securing the nation’s energy future. The industry has reached a critical inflection point where its continued trajectory is no longer guaranteed by market demand alone.

The Path Forward Amidst Policy Headwinds

The situation ultimately highlighted a crucial lesson in modern industrial strategy. The solar sector had conclusively demonstrated its immense capacity for robust growth and innovation when operating within a certain and supportive investment climate. The central challenge that emerged was not a question of the industry’s capability or market demand, but rather one of ensuring policy coherence and long-term stability from government partners. The debate swiftly evolved from whether the United States could build a world-class solar manufacturing ecosystem to whether it would sustain the predictable policy framework required to protect its leadership position. It became evident that initial incentives and investments were only the first step; enduring success required a steadfast commitment to prevent hard-won progress from being undone by short-term policy shifts, especially as global competitors stood ready to capitalize on any perceived hesitation from the U.S. market.