The United Kingdom’s latest foray into harnessing the power of the North Sea has culminated in a momentous yet controversial outcome, securing an unprecedented amount of clean energy while simultaneously igniting a fierce debate over the rising cost of its green transition. This landmark auction awarded contracts for a record 8.4 gigawatts (GW) of new offshore wind capacity, a critical step toward the nation’s ambitious 2030 climate goals. However, this success comes with a significant economic caveat: the guaranteed price for this electricity has reached its highest level in a decade, reversing a long-standing trend of falling costs. This dual result has placed the government’s energy strategy under intense scrutiny, framing a national conversation around the delicate balance between environmental ambition, energy security, and consumer affordability.

A Landmark Victory or a Costly Gamble for Britain’s Green Future

The results of the auction can be viewed through two starkly different lenses. On one hand, the sheer volume of new power secured represents a significant victory for the UK’s decarbonization efforts. Proponents, including Chris Stark, who heads the government’s clean power initiative, have lauded the outcome as a resounding success, emphasizing its importance in keeping the country’s climate targets within reach. This massive injection of renewable energy is seen as a vital move to bolster national energy independence and shield the economy from the volatility of global fossil fuel markets.

In contrast, critics argue that the government has engaged in a costly gamble, locking the public into high electricity prices for the next two decades. The reversal of the downward cost trajectory for offshore wind has provided significant ammunition for the political opposition, which contends that the administration has broken promises to lower household energy bills. This perspective highlights not only the direct cost of the contracts but also the “hidden” expenses associated with integrating such a vast amount of intermittent renewable power into the national grid, suggesting a future of rising, not falling, consumer expenses.

Setting the Stakes for a 2030 Clean Power Grid

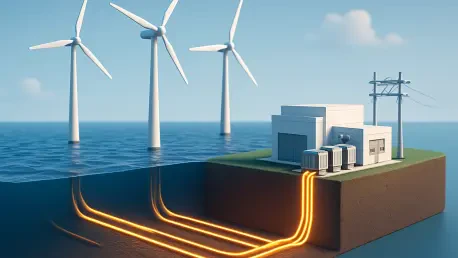

The intense focus on this single auction is rooted in the UK’s overarching national strategy to create a clean power system by 2030. The government has set a formidable target to have at least 95% of Great Britain’s electricity generated from clean sources, including renewables and nuclear, within the next four years. Offshore wind is the undisputed cornerstone of this plan, leveraging the nation’s significant natural advantages in wind resources to replace traditional fossil fuel power plants and drive the transition to a net-zero economy.

Achieving this vision requires meeting a specific and challenging milestone: establishing at least 43 GW of operational offshore wind capacity by 2030. Before this latest auction, the UK had 16.6 GW online and another 11.7 GW already under construction. The newly secured 8.4 GW is therefore an essential piece of the puzzle, making the 43 GW target mathematically possible, if still incredibly difficult. Without this record-breaking result, the 2030 goal would have been all but unattainable, underscoring the high stakes involved in every round of contract awards.

The Auction’s Dual Outcome of Unprecedented Power and Rising Prices

The auction’s results paint a detailed picture of both triumph and economic strain. The 8.4 GW of new capacity is distributed across several large-scale projects, creating a geographically diverse portfolio that enhances grid resilience. Key projects include the first phase of Berwick Bank off the coast of Scotland, which could become the world’s largest offshore wind farm, alongside major developments like Dogger Bank South in Yorkshire, Norfolk Vanguard off East Anglia, and Awel Y Mor in Wales. This geographic spread is strategically important, as it facilitates more efficient distribution of power to homes and businesses across the country.

However, this impressive haul of clean energy was secured at a noticeably higher price. The average fixed price for traditional seabed-fixed projects reached nearly £91 per megawatt-hour (MWh), a substantial increase from the £82/MWh awarded in the last comparable auction, with both figures adjusted to 2024 prices for an accurate comparison. This price hike marks a significant turning point, ending a decade-long period where each successive auction delivered cheaper wind power. The economic headwinds responsible for this shift are global in nature, including persistent supply chain disruptions, elevated steel costs, and the high interest rates that have made financing massive infrastructure projects more expensive, pressures previously exemplified when Orsted canceled its Hornsea 4 project in 2023.

A Political Firestorm over Affordability and Security

The rising costs have inevitably fueled a sharp political clash over the financial implications of the UK’s net-zero transition. The government, led by Energy Secretary Ed Miliband, has vigorously defended the auction results as a “prudent long-term investment.” Officials argue that, at £91/MWh, offshore wind remains significantly cheaper than building new gas-fired power plants, estimated to cost £147/MWh once carbon pricing is included. Miliband asserted that investing in renewables is the only sustainable way to “bring down bills for good” by permanently insulating the country from chaotic global gas markets, which he termed a “massive gamble” with public finances.

This defense has been met with pointed criticism from the opposition. Shadow Energy Secretary Claire Coutinho accused the government of locking consumers into the “highest prices we’ve seen in a decade” and failing to deliver on promises of lower bills. She further argued that the headline price of wind contracts ignores the substantial “hidden costs” required for massive grid upgrades to support renewable energy. This debate has drawn in other political parties, with some criticizing the overall cost of net-zero policies, while others advocate for an even faster expansion of renewables to combat climate change and create green jobs, reflecting the deeply divided views on the nation’s energy future.

The Bottom Line for the Grid and Consumer Wallets

Ultimately, the direct impact of these new wind farms on household bills remains complex and uncertain. The contracts operate on a fixed-price model, which can lead to either a subsidy paid by consumers or a rebate paid back to them, depending on whether the fixed £91/MWh price is above or below the future wholesale market price of electricity. Because the wholesale price is largely dictated by the cost of natural gas, the financial outcome for consumers hinges on the future of volatile global energy markets. While older renewable projects have at times required subsidies, they have also delivered significant savings by displacing expensive gas-fired power plants, thereby lowering overall market prices.

Beyond the immediate financial calculations lies the monumental challenge of implementation. Securing the contracts was only the first step; the Herculean task of building these enormous wind farms and connecting them to the national grid by the 2030 deadline is now the primary hurdle. As Nick Civetta of Aurora Energy Research noted, the journey from contract award to full operation will be “extremely challenging.” This process also involves navigating environmental regulations and addressing concerns from groups like RSPB Scotland, which has raised alarms about the potential impact of the Berwick Bank project on local seabird populations, highlighting the difficult balance between accelerating progress and ensuring environmental protection.

The conclusion of this auction marked not an end, but a beginning. It cemented the central role of offshore wind in the UK’s energy strategy while simultaneously exposing the growing economic and logistical pressures facing the green transition. The debate decisively shifted from whether the nation should pursue renewable energy to how it could affordably and efficiently deliver on its promises. The signed contracts were less a final victory and more the firing of a starting pistol for a demanding, four-year race against the clock, a race in which the fate of the country’s climate targets and the stability of household budgets were inextricably linked.