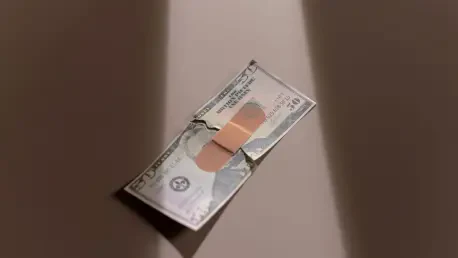

Cuba finds itself in the throes of a severe energy crisis that has crippled its national electrical grid, leaving millions to endure persistent blackouts and a lack of essential services like electricity and clean water. This dire situation stems from an infrastructure rooted in outdated Soviet-era technology from decades past, which has deteriorated due to chronic underfunding and neglect. The consequences are felt daily, as power outages disrupt households, businesses, and critical systems across the island. Beyond the immediate hardships, this crisis reveals a deeper structural problem that demands urgent and substantial investment to rebuild and modernize the energy sector. While the need for reform is clear, the path forward is fraught with complexities, from historical policy missteps to the daunting task of integrating new technologies and attracting private capital in an uncertain environment. This pressing issue not only affects the quality of life for Cubans but also poses significant challenges for potential investors eyeing the sector.

Lessons from Past Energy Policies

The energy predicament in Cuba has deep historical roots, marked by policies that favored temporary relief over lasting solutions. In the early 2000s, Fidel Castro launched an initiative known as the “Energy Revolution,” which sought to mitigate widespread power shortages through measures like distributing energy-efficient light bulbs and deploying diesel generators. While these steps provided short-term respite, they failed to address the fundamental decay of the national grid, composed largely of aging thermoelectric plants. The reliance on stopgap measures created a costly and inefficient system, leaving the infrastructure vulnerable to breakdowns. Decades later, the consequences of these decisions are evident as blackouts remain a persistent issue, underscoring the need for a more strategic, long-term approach to energy planning that prioritizes sustainable development over quick fixes.

More recently, the Cuban government has introduced what some call “Energy Revolution 2.0,” pivoting toward solar farms as a potential remedy for the ongoing crisis. However, skepticism abounds regarding the effectiveness of this latest effort, as solar installations alone cannot sustain a national grid without critical supporting systems like robust transmission lines and transformer stations. These components, essential for distributing power effectively, are currently inadequate or entirely absent in many areas. Critics argue that without addressing these foundational gaps, the push for solar energy risks becoming another superficial solution, echoing past failures. The lesson is clear: any meaningful progress must involve comprehensive planning that goes beyond surface-level interventions to rebuild the grid from the ground up, ensuring reliability for the population.

Hurdles in Adopting Renewable Energy

Transitioning to renewable energy sources like solar and wind holds promise for addressing Cuba’s power shortages, but the process is far from straightforward. The country lacks the sophisticated infrastructure needed to integrate these technologies into a cohesive national grid, including systems for interconnection, distribution, and control. Such systems are not only technically complex but also prohibitively expensive, presenting a significant barrier for a nation already grappling with financial constraints. The absence of these components means that even if renewable projects are installed, their ability to deliver consistent power remains limited. This challenge is compounded by the need for expertise and resources to manage decentralized energy sources effectively, an area where Cuba currently falls short.

Global examples further illuminate the difficulties of managing renewable energy integration, even in more advanced economies. Instances of large-scale blackouts in countries with modern grids demonstrate that balancing distributed energy sources requires meticulous planning and robust technology—elements that are scarce in Cuba’s current landscape. For the island nation, the task is magnified by its outdated systems and limited access to capital for upgrades. While renewables offer a path toward sustainability, their implementation demands a level of investment and technical capacity that remains elusive. Addressing these hurdles will require not only financial backing but also a concerted effort to build the necessary frameworks, ensuring that green energy can truly power the nation without exacerbating existing vulnerabilities.

The Critical Role of Private Capital

Given the Cuban state’s financial insolvency, turning to private investment emerges as the most viable option for revitalizing the energy sector. Experts estimate that modernizing the grid requires billions of dollars—an amount far beyond the government’s reach amid ongoing economic struggles. Private capital could provide the resources needed to overhaul aging infrastructure, introduce modern technologies, and establish a reliable power supply for the population. However, energy projects are inherently long-term commitments that carry substantial risks, particularly in an environment where economic and political stability is uncertain. The scale of funding and the extended timelines involved make it imperative to create conditions that can attract and sustain investor interest over decades.

Despite the clear need for external funding, the Cuban energy market presents a challenging landscape for private entities. The history of economic policies on the island does not inspire confidence, as past experiences in other sectors have shown that investments can be jeopardized by sudden shifts in regulations or government priorities. For private investors to commit to such a capital-intensive sector, there must be assurances of a predictable and supportive environment. This includes not only financial incentives but also a commitment to safeguarding investments against potential disruptions. Without these guarantees, the prospect of private capital flowing into the energy sector remains distant, leaving the grid’s modernization in limbo and the population to bear the brunt of continued outages.

Navigating Investor Risks and Uncertainties

For potential investors, the Cuban energy sector is a minefield of risks that could deter even the most optimistic stakeholders. Historical precedents in other industries reveal instances of asset confiscation, frozen dividends, and breached contracts, creating a legacy of distrust. The uncertainty surrounding property rights and the lack of dependable legal recourse further compound these concerns, as investors face the possibility of losing significant capital without a clear path to resolution. Such risks are particularly acute in energy infrastructure, where projects often span decades and require consistent policy support to yield returns. The fear of unpredictable government actions looms large, making caution a dominant factor in investment decisions.

Beyond legal and policy risks, the economic environment in Cuba adds another layer of complexity for investors. Currency restrictions and challenges in repatriating profits pose practical barriers to financial returns, even if projects are successful. The combination of these factors creates a high-stakes gamble for private entities considering entry into the market. Mitigating these risks will require more than superficial promises; it demands tangible reforms that address historical grievances and provide a secure foundation for long-term commitments. Until such measures are in place, the energy sector is likely to struggle in attracting the substantial capital needed to break the cycle of blackouts and infrastructure decay that plagues the nation.

Crafting a Stable Investment Framework

To unlock the potential of private investment in the energy sector, the Cuban government must prioritize the creation of a stable and trustworthy environment. This begins with establishing legal security through independent judicial systems that can impartially resolve disputes and protect investor rights. Transparent regulations, coupled with tax incentives, could further encourage participation by reducing financial burdens and clarifying expectations. Additionally, respecting property and contractual agreements—potentially backed by international arbitration—would signal a commitment to fair dealings. These steps are essential to building confidence among investors who are wary of the risks associated with long-term energy projects in an unpredictable setting.

Equally important is addressing the financial mechanisms that enable investment returns, such as allowing profits to be repatriated in foreign currency. Without this flexibility, even successful ventures could falter under economic constraints, discouraging participation. Implementing these reforms would represent a significant shift in how the government approaches economic partnerships, moving away from past practices that have hindered progress. By fostering an environment of trust and predictability, the foundation can be laid for meaningful investments that modernize the grid. Such changes would not only benefit investors but also deliver lasting improvements to the quality of life for Cubans, who have endured the effects of an unreliable energy system for far too long.

Pathways to Energy Recovery

Reflecting on the journey through Cuba’s energy challenges, it becomes evident that past efforts fell short due to a lack of foresight and sustainable planning. Historical initiatives, while well-intentioned, often prioritized immediate relief over the structural reforms needed to prevent recurring crises. The push for renewables faced significant obstacles, hindered by inadequate infrastructure and resources, while the risks for private investors remained a persistent barrier to progress. Each misstep along the way contributed to a deepening crisis that left the population grappling with the consequences of an unreliable grid.

Looking ahead, the focus must shift to actionable solutions that pave the way for recovery. Establishing a robust legal and economic framework to attract private capital stands as a critical next step, offering a lifeline to an ailing sector. International partnerships could also play a role, providing technical expertise and funding to support renewable integration. By committing to these reforms, the groundwork can be laid for a resilient energy system that meets the needs of the present while securing stability for the future. The path forward requires bold decisions and sustained effort, but it holds the promise of transforming a long-standing challenge into an opportunity for growth.