In an era where the digital economy is expanding at an unprecedented pace, the backbone of technological innovation often lies in the less visible but critical infrastructure that powers it, and the recent acquisition by Windjammer Capital of PDU Cables and Engineered Products Company (EPCO) signals a strategic move to address the escalating demand for reliable power distribution solutions in data centers and mission-critical environments. Announced on September 19, this deal not only marks the launch of a new power infrastructure platform but also highlights the pressing need for scalable systems to support advancements in artificial intelligence (AI), cloud computing, and the Internet of Things (IoT). With data center power demand projected to surge dramatically in the coming years, this partnership positions both companies at the forefront of an industry poised for significant expansion. The alignment of investment expertise with niche manufacturing capabilities offers a glimpse into how targeted acquisitions can fuel growth in specialized sectors.

Strategic Investment in Power Infrastructure

Building a Robust Platform for Expansion

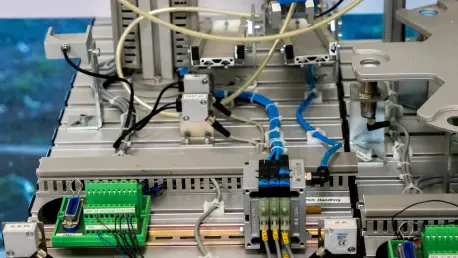

Windjammer Capital, a private equity firm with a focus on middle-market investments, has strategically chosen PDU Cables and EPCO to anchor its new power infrastructure platform. This acquisition reflects a deep understanding of the growing need for critical power solutions as data-intensive technologies continue to reshape industries. PDU Cables, established in 1981, specializes in power whips—pre-assembled cable assemblies vital for delivering electricity in data centers, hospitals, and telecommunications facilities. With over 7,000 installations across North America, the company has built a reputation for rapid delivery and ease of installation. Meanwhile, EPCO, founded in 1976, complements this expertise by designing specialty electrical products for diverse applications, from commercial to agricultural settings. Together, operating from a shared facility in Minnetonka, Minnesota, these companies present a strong foundation for Windjammer to capitalize on emerging market opportunities through organic growth and potential mergers.

Leveraging Market Trends for Growth

The driving force behind this acquisition is the explosive growth in data center power demand, expected to rise from current levels to over 80 GW by 2030, according to industry projections. This surge, fueled by AI model training and hyperscaler expansion, underscores the urgency for reliable power distribution systems that can be deployed quickly and efficiently. Windjammer’s leadership recognizes the unique positioning of PDU Cables in this space, with its core power cabling segment already a market leader. The firm plans to expand into adjacent product categories and services, enhancing the company’s offerings to meet evolving customer needs. Additionally, the financial backing from Windjammer Capital Fund VI LP, which closed with $1.3 billion in commitments, provides the resources necessary to accelerate this growth trajectory. This strategic vision aligns with broader industry trends, where adaptability and scalability are becoming non-negotiable in supporting the digital economy’s relentless pace.

Future Prospects and Industry Impact

Addressing Technological Demands with Innovation

As technology continues to advance, the pressure on power infrastructure to keep pace has never been greater. The partnership between Windjammer Capital, PDU Cables, and EPCO is poised to tackle these challenges by prioritizing innovation and operational excellence. CEO Troy Peterson has emphasized the companies’ commitment to maintaining high standards of customer service, particularly in quick delivery and installation efficiency. This focus is critical in environments where downtime can result in significant losses, such as data centers and healthcare facilities. By leveraging Windjammer’s extensive experience in the power management sector, the companies aim to explore new product segments that address emerging needs driven by connected devices and IoT applications. This proactive approach not only strengthens their market position but also ensures they remain agile in responding to the dynamic demands of mission-critical industries over the next several years.

Shaping the Future of Power Solutions

Looking back, the acquisition of PDU Cables and EPCO by Windjammer Capital stood as a pivotal moment in addressing the unprecedented demand for data center power solutions. The collaboration harnessed the combined strengths of niche manufacturing expertise and substantial investment resources to drive innovation in a sector integral to the digital age. Moving forward, the focus shifted to actionable strategies, such as streamlining operations for greater efficiency and exploring adjacent markets to broaden service offerings. The shared vision among stakeholders was clear: to maintain a competitive edge by delivering scalable, high-quality solutions that powered the technologies of tomorrow. Supported by financial advisors like Citizens JMP Securities and Baird, this transaction laid the groundwork for sustained growth, offering a model for how targeted investments could transform critical infrastructure industries in response to evolving global needs.