I’m thrilled to sit down with Christopher Hailstone, a seasoned expert in energy management and renewable energy, who brings a wealth of knowledge on electricity delivery and grid reliability. With a deep understanding of the utilities sector, Christopher offers unparalleled insights into the strategic moves and market trends shaping the pipeline industry. Today, we’ll dive into the latest developments at a major Canadian pipeline operator, exploring their ambitious profit forecasts, massive project investments, strategic acquisitions, and bold financial decisions. We’ll uncover the drivers behind their growth and the broader implications for energy demand in the U.S. and beyond.

How do you see the projected core profit of C$20.2 billion to C$20.8 billion for 2026 reflecting the current market dynamics, and what key elements are fueling this optimism?

I think this forecast is a strong signal of confidence in both the market and the company’s strategic positioning. The projected jump from this year’s expected range of C$19.4 billion to C$20 billion shows they’re tapping into some robust demand trends, especially in the U.S. where power needs are soaring due to tech-driven sectors like AI and data centers. A big piece of this growth comes from new projects coming online, which are set to add significant capacity and revenue streams. Behind the scenes, these projections likely stem from meticulous modeling—think detailed demand forecasts, project timelines, and risk assessments. I recall a time early in my career when I was part of a similar planning process; we’d spend late nights poring over data, debating every variable, feeling the weight of each billion-dollar decision in the room. It’s a grind, but when you see a project come to life and meet those numbers, it’s incredibly rewarding.

Can you elaborate on the C$8 billion in new projects slated for 2026 and how they align with the surging U.S. power demand?

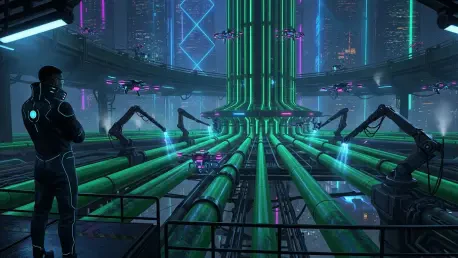

Absolutely, this C$8 billion investment is a game-changer, focusing on expanding pipeline infrastructure to meet the unprecedented energy needs we’re seeing. These projects are largely tied to transporting natural gas and other resources critical for powering data centers and AI infrastructure, which are driving record-high U.S. power demand. One example might be a major pipeline expansion—think hundreds of miles of new lines cutting through challenging terrain, designed to deliver directly to key hubs. Planning something of this scale isn’t just about engineering; it’s about navigating regulatory hurdles, community concerns, and tight timelines. I’ve been in rooms where the tension was palpable as we wrestled with delays or unexpected costs, but the vision of powering the future keeps you pushing. These projects aren’t just pipes in the ground; they’re lifelines for the tech boom, ensuring the energy is there when and where it’s needed most.

How has the $14 billion acquisition of utilities like East Ohio Gas and Questar Gas transformed operational strategies or opened new opportunities?

That acquisition was a bold move, reshaping the company’s footprint and diversifying its portfolio overnight. Integrating these utilities—each with its own customer base, infrastructure, and regulatory landscape—has likely meant rethinking operational efficiencies and customer service models to align with broader goals. The real benefit, though, is the expanded reach into new markets, giving them a stronger foothold in regions hungry for reliable energy. I’d imagine the integration involved everything from harmonizing IT systems to retraining staff, which is no small feat. I remember a project years ago where we merged two smaller utilities; the first few months were chaos, with clashing cultures and tech glitches, but once we got everyone rowing in the same direction, the synergy was undeniable. It’s that kind of grit and long-term vision that turns a pricey acquisition into a goldmine of opportunity.

What’s driving the decision to ramp up growth capital from C$7 billion in 2025 to C$10 billion in 2026, and where do you anticipate this funding will make the biggest impact?

This jump in growth capital reflects a clear bet on future demand and the need to stay ahead of the curve. Moving from C$7 billion to C$10 billion signals they’re not just maintaining pace but accelerating investments to capture emerging opportunities, especially in pipeline expansions and possibly renewable tie-ins. I’d wager a significant chunk of this will go toward infrastructure projects that directly feed into high-growth areas like data center clusters. It’s about building capacity now for a demand spike that’s already on the horizon. I’ve seen this kind of aggressive capital deployment before—once on a project where we doubled our budget mid-cycle to seize a market gap, and the gamble paid off with returns years ahead of schedule. This level of investment also ties into a longer-term vision of sustainable growth, ensuring they’re not just reacting but shaping the energy landscape.

What can you tell us about the reasoning behind the recent 3% quarterly dividend increase to 97 Canadian cents per share, and how does this move resonate with stakeholders?

Raising the dividend by 3% to 97 Canadian cents per share is a strong statement of confidence in sustained cash flow and future growth. It’s likely driven by the solid outlook for 2026 profits and the steady returns expected from new projects and acquisitions. This decision would have come after rigorous boardroom discussions, weighing shareholder expectations against reinvestment needs—I can almost hear the debates over balancing immediate payouts with long-term capital plans. For shareholders, this is a welcome signal; it’s not just a return on investment but a nod that the company sees smooth sailing ahead. I recall a similar moment in a past role when we pushed through a dividend hike; the mood at the announcement was electric, with investors sending appreciative notes, feeling truly valued. It’s a small percentage, but psychologically, it cements trust and loyalty, which are priceless in this industry.

What’s your forecast for the pipeline industry’s role in meeting tech-driven energy demands over the next decade?

Looking ahead, I believe the pipeline industry will be absolutely central to powering the tech revolution, especially as AI and data centers continue to scale at a staggering pace. We’re talking about a sector that could see demand double in key regions, requiring not just more pipelines but smarter, more efficient systems to handle the load. The challenge will be balancing this growth with sustainability pressures—there’s a real push to integrate cleaner energy sources alongside traditional fuels. My forecast is cautiously optimistic: with the right investments, like the C$10 billion we’ve discussed, and a focus on innovation, pipelines can be the backbone of this new energy era. But it won’t be easy; regulatory and environmental hurdles will test every player in the game. I’m eager to see how this unfolds, knowing the stakes couldn’t be higher for our digital future.