The relentless expansion of artificial intelligence has created an insatiable appetite for electricity, a demand that is rapidly outstripping the capacity of traditional power grids and creating a significant bottleneck for technological growth. In a novel move that captured Wall Street’s attention, aircraft engine leasing company FTAI Aviation announced a bold plan to bridge this energy gap by repurposing its vast inventory of commercial jet engines for a new life on the ground. The announcement of its “FTAI Power” division sent the company’s shares soaring by 14.4% to close at $197.68, as investors embraced the creative strategy to power the data centers of tomorrow with the aviation technology of today. The core of the venture involves converting widely used CFM56 jet engines into modular 25-megawatt aeroderivative gas turbines, designed for rapid deployment to meet the acute electricity needs of AI-focused facilities.

A Strategic Pivot to Power Generation

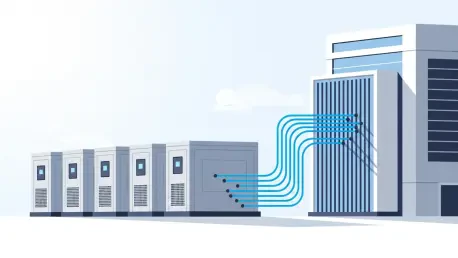

At the heart of this initiative lies FTAI’s strategic decision to leverage its substantial existing assets, which include an inventory of over 1,000 engines and more than one million square feet of dedicated maintenance facilities. This approach offers a significant time advantage over conventional solutions, as these smaller, modular power units are engineered to be deployed far more quickly than traditional grid buildouts or new industrial turbines, which often face multi-year wait times. The plan targets an acute market anxiety over power availability that has become a major hurdle for the expansion of hyperscale data centers. Production is slated to commence in 2026, with the company ambitiously projecting the capability to deliver more than 100 of these repurposed power units per year, creating a scalable solution to a growing infrastructure problem by transforming aviation assets into critical energy infrastructure for the digital age.

The strategic shift was met with considerable optimism from financial analysts, who view the venture as a shrewd monetization of the company’s core assets. A Jefferies analyst projected that the new business could generate over $750 million in annual EBITDA once it reaches full run-rate. Meanwhile, RBC Capital highlighted the plan’s dual benefit, stating that the pivot could significantly “elongate” the life of the successful CFM56 engine program while simultaneously strengthening FTAI’s valuable aftermarket business. This positive outlook led RBC to reiterate its “Outperform” rating on the stock and maintain a $200 price target. The overarching consensus on Wall Street is that FTAI has identified a clear and pressing demand from the technology sector and is uniquely positioned to meet it by creatively repurposing its extensive aviation resources, effectively turning a potential liability of aging engines into a high-demand asset.

Navigating the Path From Concept to Reality

Despite the enthusiastic market reception and compelling business logic, the primary hurdle and immediate focus for investors is the significant execution risk associated with the venture. While the concept drew widespread attention, FTAI has not yet disclosed any signed customer orders or definitive contracts, a fact that tempers the initial excitement. The “bear” case centers on a critical question: can the company successfully convert these sophisticated jet engines to meet the entirely different and rigorous reliability and service standards required by the power generation market, and can it achieve this transformation at a commercial scale? This transition from aviation leasing to power production represents a formidable operational challenge, moving the company into a new, highly demanding industrial sector where uptime and consistent performance are paramount and the technical requirements differ significantly from those in aerospace.

Following the announcement, traders closely monitored the stock’s performance as it approached the key psychological resistance level of $200, with its session low near $171 serving as an important support reference. The next major catalyst for the company was expected to be its mid-February earnings report, an event where investors anticipated receiving more granular information on the new venture. Stakeholders were particularly keen to understand the specifics of capital allocation for FTAI Power and the projected profit margins. The announcement created a clear demand for validation, and the market looked toward key future milestones—including successful testing, certification, manufacturing throughput, and the announcement of initial customer wins—which were seen as essential steps to substantiate the business model and begin building a credible bookings pipeline.