In an industry where compliance deadlines collide with production targets and emissions reporting, the promise of one platform that unites regulatory rigor with real-time field performance has become more than a wish list item for operators across basins, it has become a necessity shaped by pressure from regulators, investors, and the market. Energy Overwatch’s acquisition of Porosity signaled a bet that compliance can be transformed from a retrospective reporting exercise into a forward-leaning operating system. By pairing software, AI, and field services, the combined company set out to shrink the distance between plan and execution, reduce manual reconciliations, and deliver operational intelligence that moves as fast as the assets. The intent is not just a cleaner audit trail; it is stronger uptime, earlier issue detection, and a tighter link between ESG goals and daily work.

Strategy: Uniting Compliance, Ops, and Data

Energy Overwatch entered this deal with a clear thesis: consolidation beats fragmentation when compliance and operations fight for attention in the same workday. Its SEMS, emissions-management, and regulatory reporting tools already anchored a compliance-first posture, but many operators still juggled SCADA dashboards, production systems, and point solutions that rarely shared context. By fusing Porosity’s software stack into that foundation, the company targeted convergence rather than coexistence. Workflows that start with standards and procedures can now pull in real-time signals, suggest corrective actions, and feed back into reporting without hopping platforms. Upstream and midstream stand to benefit first, yet the playbook anticipated downstream demand for similar transparency.

The logic hinges on making compliance durable in the flow of operations rather than a checkpoint at month-end. That means decisions informed by live data, audit trails created as work happens, and variance detection that closes loops before small problems escalate. Where legacy systems created silos—safety audits over here, emissions logs over there—the unified platform aims to bake controls into the same fabric that dispatches tasks and records completion. Leadership cast the move as a blend of top-tier product engineering with field-proven compliance expertise. Porosity’s technology, meanwhile, gains scale through Energy Overwatch’s customer reach and services footprint. The result positions compliance as a core function that nudges performance metrics in the right direction every shift.

Technology Integration: AI, Workflows, and Data Unification

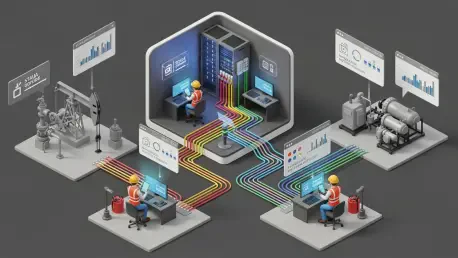

Porosity’s role sits at the intersection of analytics and orchestration. Its integrations pull emissions signals, production data, and SCADA into a common model, then apply AI to flag anomalies, detect variances, and recommend next steps. Automated workflows route issues to the right teams with context intact, replacing email chains and spreadsheet chases with action paths that are tracked from alert to resolution. Predictive models, trained on operational patterns, look for precursors to leaks, downtime, or permit deviations. The aim is not to drown users in alerts but to surface the earliest indicators with enough specificity that crews can prevent escalation. By normalizing data streams that rarely agree on format or timing, the platform reduces the friction that slows analysis.

This stack also changes how emissions management fits within everyday operations. Instead of periodic rollups and manual reconciliations, emissions signals are embedded directly into field workflows, giving supervisors the chance to mitigate or schedule remediation before compliance risk accumulates. Asset performance analytics run in the same environment, tying production swings or compression behavior to potential root causes. SCADA becomes more than a visual dashboard; it becomes a trigger system for automated checks that satisfy SEMS expectations and operational KPIs simultaneously. Crucially, the software does not float above reality. Through field services and consulting, data quality is verified, device configuration is adjusted, and adoption hurdles are addressed, creating the feedback loops that AI models need to stay accurate and trustworthy.

Execution Plan: Teams, Timeline, and Scale

The transaction closed on November 21, 2025, and the combined company kept its headquarters in Greenwood Village, Colorado. Technology and commercial teams expanded in Houston, Texas, Lafayette, Louisiana, and in key producing basins to stay close to field operations. That footprint matters, because integrating SCADA, production, and emissions data is as much about equipment, telemetry, and change management as it is about code. The rollout approach paired product integration with hands-on services: data mapping, workflow configuration, and training that aligns supervisors, measurement teams, and compliance leads. National customer relationships provided the channel, while the services organization ensured that platform features translated into daily habits.

Customer impact was defined by speed and confidence. Operators gained a single environment where SEMS procedures aligned with live work orders, where variance detection informed dispatch, and where regulatory reporting drew from the same validated data that guided the field. Early adopters focused on high-value use cases: emissions variance alerts tied to compressor duty cycles, production deviations linked to maintenance backlogs, and automated incident-prevention checks tied to permit conditions. The commercial strategy leaned on measurable outcomes—faster closure of variances, reduced manual reconciliations, and improved uptime—to drive expansion within existing accounts. Taken together, this integration compressed the time from data to decision and turned compliance into a performance lever rather than a cost center.