A Pivotal Moment for Energy Storage Dynamics

In a landscape where energy storage is critical to balancing renewable energy integration, a staggering fact emerges: lithium-ion batteries, despite their dominance, face mounting supply chain constraints and safety concerns. This challenge sets the stage for a transformative shift in the U.S. market, spotlighted by a groundbreaking $500 million deal between Peak Energy, a Denver-based innovator, and Jupiter Power, a leading independent power producer. This agreement, the largest of its kind for sodium-ion batteries in the U.S., promises to deliver up to 4.75 gigawatt-hours (GWh) of capacity by 2030. The significance of this development lies in its potential to diversify storage solutions and address pressing industry bottlenecks. This market analysis explores the implications of the partnership, dissects current trends in energy storage, and projects the trajectory of sodium-ion technology amid evolving market forces.

Deep Dive into Market Trends and Strategic Insights

Unpacking the Peak Energy-Jupiter Power Collaboration

The cornerstone of this market shift is the ambitious contract between Peak Energy and Jupiter Power, which secures the supply of sodium-ion batteries starting with an initial 720 megawatt-hours (MWh) in 2027, scaling to a total of 4.75 GWh by 2030. This phased rollout targets high-demand grid regions such as the Electric Reliability Council of Texas (ERCOT) and PJM Interconnection, aligning with Jupiter Power’s expansive portfolio exceeding 12 gigawatts (GW) of projects. The deal not only underscores a commitment to alternative chemistries but also positions both companies as frontrunners in addressing grid-scale storage needs. Financially, the agreement’s value signals strong investor confidence in sodium-ion’s viability, though execution risks like timely delivery and performance consistency across diverse environments remain key hurdles to monitor.

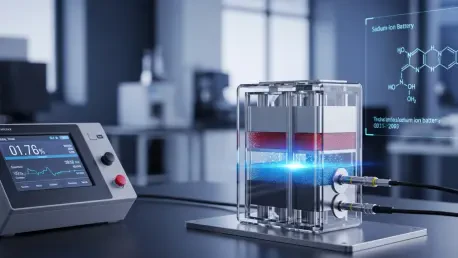

Sodium-Ion Technology: A Competitive Edge

Sodium-ion batteries stand out due to their innovative features, offering a fresh perspective in a market long dominated by lithium-ion systems. Peak Energy’s design incorporates a passive cooling mechanism, slashing auxiliary power usage by up to 97% compared to traditional counterparts, which translates into significant cost savings. Additionally, claims of a 30% slower degradation rate over a 20-year lifespan suggest enhanced durability, a critical factor for long-term grid applications. These advantages, coupled with reduced maintenance demands and improved safety profiles, make sodium-ion a compelling option for utilities prioritizing operational efficiency. Yet, the technology’s lower energy density compared to lithium-ion remains a point of contention, necessitating further innovation to broaden its appeal.

Current Market Landscape and Sodium-Ion’s Position

Energy storage in the U.S. is at a crossroads, with lithium-ion batteries holding a near-monopoly, commanding over 98% of the global market share as per recent industry data from energy intelligence firms. Sodium-ion, by contrast, occupies a mere 1-2% slice, largely driven by adoption in China where lithium supply volatility has spurred diversification. In the U.S., barriers to entry include entrenched perceptions of sodium-ion’s limitations and a mature lithium-ion supply chain. However, regulatory changes, such as upcoming tax credit eligibility rules in 2026 and fluctuating tariffs on lithium imports, are creating openings for alternatives. Jupiter Power’s strategic move to partner with Peak Energy reflects a calculated effort to leverage domestic supply chains, mitigating risks tied to international dependencies and positioning sodium-ion for incremental growth.

Projections and Growth Potential for Sodium-Ion Batteries

Looking ahead, market forecasts paint a cautiously optimistic picture for sodium-ion technology within the U.S. energy storage sector. Analysts predict a modest increase in global market share to the low single-digit range by 2030, with landmark deals like this one potentially anchoring early adoption. Wood Mackenzie’s latest projections estimate U.S. storage capacity to reach 87.8 GW/261.2 GWh by 2029, creating ample room for niche technologies to carve out space, especially in applications valuing safety and cost over raw energy density. Factors such as advancements in manufacturing scalability and supportive policies for domestic production could accelerate sodium-ion’s uptake. Still, overcoming lithium-ion’s entrenched cost advantages and infrastructure will require sustained investment and market education to shift stakeholder perceptions.

Reflecting on Market Shifts and Strategic Pathways Forward

Looking back, the analysis of the Peak Energy-Jupiter Power partnership revealed a defining moment for sodium-ion batteries, highlighting their potential to address critical gaps in cost, safety, and sustainability within the U.S. energy storage market. The examination of current trends underscored the dominance of lithium-ion systems while pinpointing regulatory and economic catalysts that opened doors for alternatives. Market projections suggested a gradual but promising rise for sodium-ion technology, contingent on innovation and policy support. Moving forward, energy developers and utilities should consider pilot deployments in varied grid settings to validate scalability, while policymakers could explore incentives to bolster domestic manufacturing of alternative chemistries. Businesses in the sector might benefit from forging alliances with sodium-ion pioneers to hedge against lithium supply uncertainties, ensuring a more resilient and diversified energy storage ecosystem for the future.