In a significant move highlighting the burgeoning international interest in Canada’s renewable energy landscape, Calgary-based NU E Power Corp. has announced a landmark agreement that will see its key Alberta solar and energy storage assets transferred to a prominent South Korean private equity firm. The company has entered into a letter of intent (LOI) to sell its equity interests in three substantial projects to Green Harbor Partners Corp., a firm specializing in renewable energy and infrastructure investments. This transaction not only represents a major capital influx into the provincial energy market but also marks a pivotal strategic transition for NU E, solidifying its new business model as a dedicated project developer. This deal underscores a broader trend where Alberta’s attractive market structure and growing electricity demands are successfully drawing in strategic and financial partners from across the globe, eager to participate in the province’s energy transition. The sale is a testament to the value created in the early stages of project development and sets the stage for a new phase of growth and collaboration.

A Strategic Divestment and its Assets

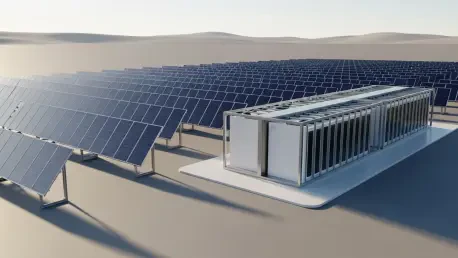

The core of this significant transaction involves a portfolio of three advanced-stage solar projects: Hanna Solar, Lethbridge Three, and Lethbridge Two, which collectively boast a planned power generation capacity exceeding 452 megawatts. NU E Power Corp. has diligently advanced these assets, investing approximately $3.6 million to reach critical development milestones that have substantially increased their value. This groundwork includes securing land control, making significant progress on interconnection agreements with the Alberta Electric System Operator, and navigating complex permitting processes. The first phase of the letter of intent has already resulted in secured interconnection approval, a crucial step that de-risks the projects for the incoming investor. The specific assets are on a clear timeline, with the 12.6 MW Lethbridge Two project expected to achieve energization in the second quarter of 2026, followed by the 140 MW Lethbridge Three installation in the third quarter of 2027, and the massive 300 MW Hanna Solar farm slated for operations in the fourth quarter of 2027. This phased approach ensures a steady integration of new renewable capacity into Alberta’s grid.

The decision to divest these assets is a calculated move reflecting NU E’s corporate philosophy. CEO Broderick Gunning characterized the sale as an exercise in “timing, discipline and capital efficiency,” emphasizing the company’s strategy of creating value through development and then monetizing assets at an opportune moment to fund its next wave of projects. While the final sale value remains confidential pending market and competitive evaluations, the terms of the LOI are structured to provide NU E with sustained benefits. The agreement allows the company to retain a “meaningful” long-term economic stake in the projects’ success, likely through a royalty agreement or a carried interest. This structure enables NU E to transition its business model effectively, moving from an asset owner to a pure-play project developer that can recycle capital more efficiently. This sale serves as the first major proof point of this strategic pivot, demonstrating an ability to cultivate projects to an attractive stage and then partner with well-capitalized firms for construction and operation.

Forging a Global Partnership for Future Growth

This transaction is designed to be more than a simple asset sale; it is the cornerstone of a broader, long-term strategic partnership between NU E and Green Harbor Partners. The collaboration is poised to extend well beyond the initial Alberta portfolio, with both firms planning to jointly develop, finance, and operate a pipeline of renewable and hybrid power projects. The initial focus will remain in Alberta, capitalizing on the province’s robust market, before expanding their joint efforts into promising global markets. Potential regions targeted for this expansion include Latin America, Southeast Asia, and the Middle East and North Africa, where the demand for clean and reliable energy is rapidly accelerating. This partnership leverages the distinct strengths of each company: NU E’s development expertise and agility, combined with Green Harbor’s substantial financial backing and global reach in the infrastructure investment sector, creating a formidable team for large-scale energy development.

The integration of advanced energy solutions is a central theme of both the current transaction and the future partnership. Battery energy storage systems are being actively evaluated for inclusion across all three Alberta solar projects, a strategy that NU E’s leadership views as “increasingly essential” in the modern energy market. This hybrid approach is critical for managing price arbitrage, allowing for the storage of energy when prices are low and its sale when prices are high. Furthermore, battery storage provides vital grid services, such as frequency regulation and voltage support, which enhance the stability and reliability of the electricity system. This capability is becoming ever more critical with the exponential growth in electricity demand driven by power-hungry sectors like artificial intelligence and digital infrastructure. By incorporating storage, these projects are better positioned to meet the complex demands of the grid while maximizing their economic viability and supporting a more resilient energy future.

A Blueprint for Global Energy Diversification

The successful negotiation of this sale solidified NU E’s corporate strategy, which centered on cultivating a diverse and international portfolio of energy projects designed to meet the escalating global demand for electricity. The capital and strategic momentum gained from the Alberta transaction were immediately channeled into advancing the company’s broader development pipeline. This portfolio extended beyond solar to include a balanced mix of natural gas, advanced nuclear technologies, and battery storage solutions, reflecting a technology-agnostic approach to ensuring grid reliability and sustainability. This strategic framework positioned the company to tackle energy challenges in various geopolitical contexts, with active projects that included a 200 MW hybrid facility in Saskatchewan, a 100 MW hybrid project in Mongolia, and a planned 100 MW site in Nigeria. This global footprint demonstrated an ambition to apply the development principles honed in Alberta to diverse markets, each with its unique energy needs and regulatory environments. The deal became a foundational piece of this larger vision for global energy development.