The once-unmistakable rumble of the gasoline engine is steadily being replaced by the quiet hum of electric motors as the automotive world passes a monumental milestone in consumer preference. For the first time, a clear majority of prospective car buyers are planning to purchase a hybrid or fully electric vehicle, signaling a fundamental and perhaps irreversible pivot away from traditional internal combustion engines. This transformation is not a distant forecast but a present-day reality, confirmed by a comprehensive consumer study that captures a definitive shift in the market. This change reflects more than just new technology; it represents a deep-seated evolution in driver priorities and expectations, reshaping one of the world’s most influential industries from the ground up.

The Twilight of the Combustion Engine

A landmark survey of over 2,000 consumers has confirmed what many industry analysts have anticipated: the era of electrified vehicles has truly arrived. An unprecedented 55% of buyers now intend to select a hybrid or fully electric car for their next purchase, crossing the majority threshold for the first time. This figure marks a pivotal moment, moving electrified options from the niche category of early adopters into the mainstream consciousness.

This is not a gradual evolution but a definitive turning point in automotive history. The data indicates that the long-standing dominance of the gasoline-powered vehicle is officially being challenged. The collective preference for electrified alternatives demonstrates a powerful momentum that is expected to accelerate, suggesting that the industry is witnessing the final years of the internal combustion engine’s reign.

A Mainstream Transformation in Motion

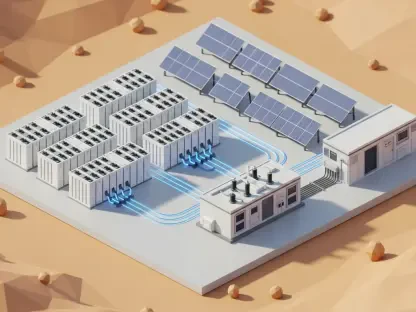

This shift in consumer intent is far more significant than a simple change in product trends. It represents a large-scale transformation impacting global manufacturing, energy infrastructure, and economic policy. As buyer demand realigns, automakers are forced to accelerate their transition plans, reallocating massive investments from legacy engine development toward battery technology, software, and charging networks.

The momentum is fueled by a convergence of factors beyond the vehicles themselves. Growing environmental consciousness, coupled with the appeal of lower running costs and reduced maintenance, has fundamentally altered what consumers value in a car. Simultaneously, rapid advancements in battery range, charging speeds, and model availability have dismantled many of the practical barriers that once limited the appeal of electric and hybrid options, making them viable choices for a much broader audience.

A Detailed Look at Buyer Preferences

Dissecting the data reveals a nuanced landscape of consumer choice. Hybrid vehicles are currently leading the charge, with 30.5% of buyers seeing them as a practical bridge technology that offers fuel efficiency without the range anxiety sometimes associated with pure electrics. Meanwhile, interest in fully electric models has hit an all-time peak, with 24% of consumers now ready to make the complete switch.

In contrast, the decline of traditional fuel types is stark. While gasoline-powered cars remain the most popular single option at 36%, their leading position is fragile, as they are now outnumbered by the combined electrified category. The most dramatic collapse is seen in the diesel market. Now considered by only 9.5% of buyers, diesel has been relegated to a marginal choice, a stunning fall from grace for a technology that was once championed for its efficiency.

The Critical Hurdle of Consumer Confidence

Despite the surge in interest, a significant confidence gap remains a critical hurdle, particularly in the used-car market. The survey reveals a sharp divide: while nearly half of all buyers are comfortable purchasing a brand-new electric vehicle, that number plummets to less than a third for a used model that is at least two years old. This hesitation points to lingering consumer concerns about long-term battery degradation and the potential costs of out-of-warranty repairs.

This confidence is not evenly distributed across demographics. The data identifies men and consumers in the 25 to 44 age bracket as the groups most comfortable with adopting EV technology. This suggests that targeted education and robust certified pre-owned programs will be essential to broadening the appeal of used EVs and ensuring the market’s long-term health as the first generation of models ages.

Practicality Over Financial Perks

Interestingly, the decision to go electric is being driven more by practical, real-world needs than by financial incentives. The survey uncovered that government grants and manufacturer discounts have a surprisingly limited influence on the overall decision-making process, with only 35% of all buyers stating that such perks would sway their choice.

For those already considering an electric vehicle, the primary motivation is finding a car that seamlessly integrates into their daily lives. Factors like sufficient range for their commute, reliability, and overall functionality take precedence over qualifying for a rebate. This indicates that the market has matured to a point where consumers are evaluating EVs not as a novelty but as practical tools, and their success now depends more on product excellence than on subsidies.

The automotive industry has clearly navigated past a tipping point, where the momentum behind electrification became the dominant force shaping consumer demand. The primary drivers shifted from early adoption and incentives toward mainstream considerations of practicality, cost, and lifestyle integration. This evolution solidified a new market reality where electrified vehicles were no longer the alternative but the emerging standard, compelling every automaker to align their future with a battery-powered world.