While headlines have fixated on the cooling demand for electric vehicles, a far more significant industrial transformation is quietly taking shape as automotive giants Ford and General Motors pivot their immense manufacturing power toward the burgeoning energy storage market. This strategic shift from passenger cars to power grids represents not just a diversification but a fundamental reassessment of where future growth lies. As the energy landscape evolves, the battle for battery dominance is moving beyond the highway and into our homes, businesses, and utility infrastructure, raising a critical question about whether Detroit’s legacy automakers can effectively compete with the established leader, Tesla.

The New Electric Battleground: Sizing Up the Energy Storage Arena

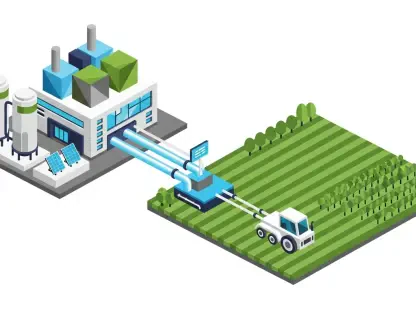

The global energy storage sector is undergoing an unprecedented expansion, driven by the urgent need to stabilize power grids increasingly reliant on intermittent renewable sources like solar and wind. Battery energy storage systems (BESS) are the linchpin in this transition, providing the reliability required to store excess energy generated during peak production and discharge it during periods of high demand or low generation. This capability is transforming the energy sector from a real-time delivery model to a more resilient, on-demand system.

For years, this arena has been dominated by a handful of key players, with Tesla standing as the undisputed leader. Leveraging its early start in battery technology and manufacturing scale, Tesla’s Energy division has set the industry standard with its integrated ecosystem of products. The market itself is diverse, segmented into three primary categories. Utility-scale projects involve massive battery installations designed to support entire power grids, while commercial solutions help businesses manage energy costs and ensure operational continuity. Finally, the residential market offers homeowners a path toward energy independence with products that store solar power for use during outages or peak pricing hours.

Shifting Gears: Market Dynamics Driving the Automotive Pivot

From EV Slowdown to Energy Boom: Why Automakers Are Diversifying

The strategic pivot by Ford and GM is directly linked to a divergence in market trends. In the U.S., the once-explosive growth in the electric vehicle market has moderated, influenced by shifting consumer preferences and policy adjustments that have relaxed pressure on phasing out combustion engines. This cooling demand has left automakers with significant investments in battery manufacturing capacity that risk underutilization, prompting a search for alternative revenue streams for their advanced battery technology.

In sharp contrast, the demand for battery storage is accelerating at a formidable pace. The rapid build-out of renewable energy projects has created a critical and growing need for grid-scale storage to ensure stability and prevent blackouts. This demand is not speculative; it is a structural necessity for the modernizing energy grid. Automakers, with their deep expertise in high-volume battery production, are uniquely positioned to redirect their capabilities to meet this surging demand, turning a potential EV overcapacity issue into a strategic energy-sector opportunity.

Charging Ahead: Projecting the Growth and Profitability of Battery Storage

The financial incentive for this pivot is compelling. The global battery energy storage market is on a steep upward trajectory, with forecasts projecting its valuation to surpass $14.5 billion by 2027. This rapid expansion offers a significant new frontier for growth at a time when traditional automotive markets face disruption. Companies that can establish a strong foothold now stand to reap substantial rewards as the energy transition continues to gain momentum over the next decade.

Tesla’s Energy segment provides a powerful and profitable precedent for this model. The company has demonstrated that energy storage is not merely an auxiliary business but a core pillar of profitability, generating $3.41 billion in revenue and deploying an impressive 43.5 GWh of storage capacity. By proving the viability and scale of this market, Tesla has created a clear playbook that legacy automakers like Ford and GM are now beginning to follow, hoping to replicate its success by leveraging their own manufacturing prowess.

Detroit’s Playbook: How Ford and GM Are Entering the Fray

Ford is making a decisive and capital-intensive entry into the energy storage market. The company has committed approximately $10 billion to convert its Kentucky battery plant, a facility originally intended for EVs, into a production hub for stationary energy storage systems. This move is aimed squarely at high-demand commercial clients, including utilities and data centers that require massive, reliable power reserves. This strategic shift, following a significant $19.5 billion write-down on its EV ventures, signals a clear focus on diversifying beyond consumer vehicles.

General Motors, in contrast, is pursuing a more multifaceted strategy through its dedicated GM Energy division. This business unit is building a comprehensive ecosystem that includes residential solutions like its PowerBank system, which integrates with home solar installations, and utility-scale offerings. Furthermore, GM’s collaboration with Redwood Materials for battery recycling and material supply points to a long-term vision for a more sustainable and vertically integrated supply chain. These distinct approaches from Ford and GM reflect different philosophies on how best to challenge Tesla’s entrenched Gigafactory model and its mature product lines like the Megapack and Powerwall.

The Regulatory Gauntlet and Supply Chain Hurdles

Navigating the complex regulatory landscape is a significant challenge for any new entrant in the energy storage market. Federal incentives and state-level policies play a crucial role in the economic viability of battery projects, and automakers must adapt their strategies to this patchwork of regulations governing grid integration and production. These policies can create immense opportunities but also introduce uncertainty that can impact investment decisions and timelines.

Beyond regulations, the logistical hurdles of retooling manufacturing plants and securing resilient supply chains are formidable. Converting a factory designed for automotive components into one that produces large-scale battery packs is a technically complex and expensive undertaking. Moreover, securing a stable and independent supply of critical minerals like lithium and cobalt is essential to avoid the bottlenecks that have plagued the EV industry. This is particularly challenging when competing against an established leader like Tesla, which has spent years cultivating its supply chain and commands a significant head start in scale, technology, and market penetration.

Powering the Future: Long Term Viability and Strategic Goals

For legacy automakers, diversifying into energy storage is more than a hedge against EV market volatility; it is a crucial step toward securing long-term relevance in an electrified world. By establishing themselves as key players in the energy infrastructure, Ford and GM can create durable revenue streams that are independent of cyclical vehicle sales. This strategic expansion positions them as comprehensive energy companies, not just vehicle manufacturers.

The established brand trust and manufacturing excellence of Detroit’s titans could become a significant competitive advantage. Utilities and large corporate clients, such as data centers, are often risk-averse and may favor partnerships with established industrial giants known for their reliability and production scale. By leveraging their legacy, Ford and GM have the potential to capture significant market share in these B2B segments. Looking ahead, the entire market remains dynamic, with emerging technologies like solid-state batteries and alternative storage chemistries holding the potential to disrupt the current landscape and create new opportunities for all competitors.

The Final Verdict: Can Detroit’s Titans Dethrone the Energy King

The strategic pivot by Ford and GM into the energy storage sector was a necessary and intelligent move. It allowed them to leverage their substantial investments in battery technology to tap into a rapidly growing market, providing a crucial counterbalance to the fluctuating demand within the electric vehicle space. This diversification represented a forward-thinking strategy to ensure their manufacturing assets remained productive and their businesses remained relevant in a rapidly evolving industrial ecosystem.

Ultimately, whether these investments and strategies were sufficient to truly challenge Tesla’s dominance in the energy sector remained an open question. While Detroit brought immense manufacturing scale and established corporate relationships to the table, Tesla’s first-mover advantage, technological lead, and deeply integrated ecosystem presented a formidable barrier. The ensuing competition reshaped the energy storage industry, creating a more dynamic and competitive landscape that promised to accelerate innovation and deployment, benefiting the broader clean energy transition.