In a high-stakes maneuver unfolding across the Caribbean, the United States has dramatically escalated its campaign to choke off Venezuela’s oil industry, deploying a combination of military pressure and stringent economic sanctions that threaten the very foundation of President Nicolas Maduro’s regime. This intensified strategy is already crippling the nation’s ability to produce and export crude oil, its primary source of revenue. While the fallout is catastrophic for Caracas, the global energy landscape appears remarkably unfazed. A confluence of factors, including strategic policy exemptions by Washington and a well-supplied international market, ensures that this targeted pressure is unlikely to trigger a significant supply crunch or a painful spike in prices for consumers around the world. The real story is not one of impending global crisis, but of a localized economic strangulation that the broader market is well-equipped to absorb without major disruption.

A Campaign of Intensified Enforcement

Washington has decisively shifted its strategy from passive sanctions to active, direct enforcement, a move underscored by an unprecedented military buildup in the Caribbean. A pivotal moment in this new phase was the U.S. Coast Guard’s seizure of a supertanker laden with Venezuelan crude in mid-ocean, signaling a new era of heightened interdiction. This action is not an isolated event but part of a broader “military chokehold” supported by the largest U.S. military presence in the region since the Cuban missile crisis. The primary objective is to dismantle the operations of the expanding “dark fleet,” a shadowy network of unregulated and often uninsured vessels that Venezuela, along with Iran and Russia, uses to circumvent international sanctions. This formidable posture creates an immediate and tangible risk for the dozens of sanctioned tankers operating within Venezuela’s maritime zone, which are now prime targets for interception and seizure by U.S. forces, further tightening the noose around the nation’s oil trade.

The direct pressure on maritime logistics is having an immediate and damaging effect on Venezuela’s state-run oil company, PDVSA, reversing a recent period of recovery. After exports briefly surged past one million barrels per day (bpd) in September 2023, a level not seen in years, they are now projected to plummet. Data from analytics firm Kpler forecasts that December exports will fall to 702,000 bpd, the lowest point since May. This sharp decline is exacerbated by weakening market dynamics, as key Asian buyers, who have been a lifeline for Venezuelan crude, are now demanding substantial discounts to compensate for the escalating risks associated with the trade. This erosion of revenue directly undermines the Maduro government’s financial stability. The export bottleneck also creates a severe logistical problem, forcing producers to curtail output as the country’s limited storage capacity fills up, leading to a significant drop in crude production in recent months.

Exploiting a Critical Operational Weakness

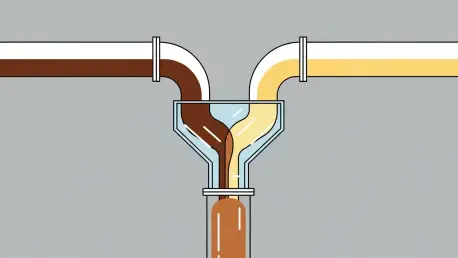

Beyond direct interdictions, the U.S. strategy cleverly targets a fundamental vulnerability at the heart of Venezuela’s oil operations: its heavy dependence on imported diluents. More than two-thirds of the country’s entire oil production consists of extra-heavy crude, particularly from the vast Orinoco Belt. This crude has a tar-like consistency at extraction, making it impossible to transport through pipelines or load onto tankers without being blended with a lighter hydrocarbon, such as naphtha, to reduce its viscosity. While Venezuela’s six domestic refineries are theoretically capable of producing the necessary diluents, they have fallen into a state of disrepair after years of chronic underinvestment, mismanagement, and neglect. This has left the nation’s upstream industry critically reliant on foreign imports to keep its most valuable asset flowing, creating an Achilles’ heel that U.S. sanctions are now systematically exploiting.

The restrictions imposed by Washington are proving highly effective at severing this crucial supply line. Data reveals a precipitous decline in inbound shipments of naphtha and other essential chemicals, which are projected to fall to just 39,000 bpd in December, a sharp drop from 54,000 bpd in November and 89,000 bpd in October. Although the precise immediate impact on oil production is difficult to quantify, as Venezuela may have accumulated strategic stockpiles of these diluents, a sustained collapse in these imports places the majority of its oil production at extremely high risk of being shut down. Without a consistent supply of naphtha to blend with its extra-heavy crude, Venezuela cannot move its oil from the fields to the ports. This targeted disruption of a critical operational input threatens to paralyze the country’s entire oil sector far more effectively than sanctions on exports alone, striking at the very beginning of the supply chain.

Global Market Resilience and Mitigating Factors

Despite the severity of the U.S. campaign, a complete halt of Venezuelan oil production remains unlikely due to a specific and significant policy carve-out. The U.S. administration has granted a special license to Chevron, the second-largest American oil producer, permitting it to continue operating its joint ventures within Venezuela. These operations are responsible for producing approximately 250,000 bpd. A substantial portion of this output, around 150,000 bpd, is exported directly to Chevron’s own refineries on the U.S. Gulf Coast. These facilities were specifically engineered decades ago to process the unique heavy crude grades that come from Venezuela, as well as Mexico and Canada. This exemption acts as a carefully calibrated pressure valve, ensuring a stable, albeit reduced, flow of Venezuelan oil while preventing a total industry collapse. Analysts estimate that the net impact of the U.S. squeeze will result in a total decline in Venezuelan production of between 300,000 and 500,000 bpd.

This potential loss, while representing a devastating blow to Venezuela’s economy, is viewed as a manageable event for the global oil market. The primary reason for this calm assessment is the current state of global supply, which is not only ample but is also facing the prospect of a “severe glut” in the coming year. In such a well-supplied environment, the removal of up to half a million barrels per day from a single producer can be absorbed with relative ease. Furthermore, the market is well-positioned to compensate for the specific type of heavy crude that Venezuela exports. Any shortfall can be readily offset by other major producers. Analysts point specifically to sharply increased output from Canada, with its vast oil sands, and the U.S. Gulf of Mexico. Both regions are major producers of similar heavy-grade crudes that can serve as direct substitutes for Venezuelan barrels, ensuring that the complex refineries designed to process this oil can continue to operate without disruption.

Beyond the Immediate Squeeze

The escalating U.S. campaign successfully hobbled Venezuela’s oil industry through a multifaceted strategy that combined direct interception, targeted sanctions, and the disruption of critical diluent supply chains. This pressure was applied with surgical precision, achieving its goal of inflicting maximum economic pain on the Maduro regime without triggering significant reverberations in the global energy market. The world’s oil supply proved more than sufficient to absorb the production loss, with alternative sources of heavy crude readily available to fill any void. The ultimate game-changer for global markets, however, was never the squeeze itself, but the potential political outcome it sought to achieve. A successful transition to a U.S.-friendly government could have unlocked Venezuela’s vast oil potential. With the world’s largest proven reserves, a stable and open Venezuela might have triggered a rush of Western energy majors back into the country, leading to a rapid and substantial revival of its oil production that would have had a far more profound and lasting impact on global energy dynamics.