Global oil markets are navigating a complex landscape of conflicting signals, where a recent uptick in prices, spurred by encouraging economic news from the United States, was quickly tempered by the looming prospect of a significant increase in global crude supply. This delicate balancing act finds traders and analysts caught between optimism for renewed demand and anxiety over a potential surplus, creating a volatile environment where even positive developments are met with caution. The market’s reaction, which saw both Brent crude futures and U.S. West Texas Intermediate (WTI) crude make modest gains before closing the week with overall losses, perfectly encapsulates the underlying uncertainty. This push-and-pull dynamic is further complicated by shifting geopolitical tensions, which add another layer of unpredictability to a market already struggling to find a stable footing. The central challenge remains deciphering which force—the hope for economic stimulus or the fear of oversupply—will ultimately dictate the direction of oil prices in the coming months.

A Tug of War Between Demand and Supply

The American Economic Influence

A primary catalyst for the recent price lift came from the United States, where newly released inflation data for January proved to be more moderate than economists had anticipated. This development was a significant piece of positive news for the market, as it immediately bolstered investor hopes that the central bank might soon consider lowering interest rates to stimulate the economy. Such a move is traditionally seen as a precursor to heightened economic activity, which in turn drives up demand for fuel across various sectors, from transportation to manufacturing. This wave of optimism translated directly into market activity, with Brent crude futures rising to settle at $67.75 per barrel, while U.S. West Texas Intermediate (WTI) crude finished the session at $62.89. However, the gains were marginal and highlighted the market’s cautious sentiment, as these daily increases were not enough to erase the losses accumulated throughout the week, signaling that traders remain wary of underlying bearish factors that could easily reverse these gains.

The potential for lower interest rates in the U.S. carries implications that extend far beyond its borders, influencing the global economic outlook and, consequently, the trajectory of worldwide energy consumption. A more accommodative monetary policy is designed to make borrowing cheaper for both businesses and consumers, encouraging investment, expansion, and spending. For the oil market, this translates into a direct demand-side stimulus. Increased manufacturing requires more energy, robust consumer spending often leads to more travel and transportation of goods, and overall economic expansion boosts the need for a wide array of petroleum products. While the immediate price reaction was positive, the fact that both Brent and WTI benchmarks still posted weekly losses underscores a deep-seated apprehension within the market. This apprehension stems from the recognition that while demand-side signals are improving, they are being met with equally powerful, if not stronger, supply-side pressures that threaten to keep a firm ceiling on any significant price rallies.

The Specter of Increased Global Output

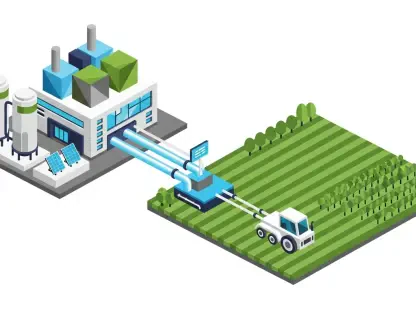

While American economic indicators provided a tailwind for oil prices, a significant headwind emerged from discussions within the OPEC+ alliance. Reports indicating that the influential group of oil-producing nations is seriously considering an increase in crude oil production starting in April sent a strong bearish signal throughout the market. This potential policy shift is reportedly aimed at proactively addressing the anticipated surge in fuel demand during the summer months, a period when consumption typically peaks. By gradually increasing output, the alliance would seek to prevent a sharp price spike and maintain market stability. However, the mere suggestion of more barrels entering an already well-supplied market was enough to apply considerable downward pressure on prices, effectively capping the gains that were driven by the positive U.S. inflation news. This development highlights the immense influence that OPEC+ continues to wield over global energy markets, as its production decisions can swiftly alter market sentiment and overshadow other economic factors.

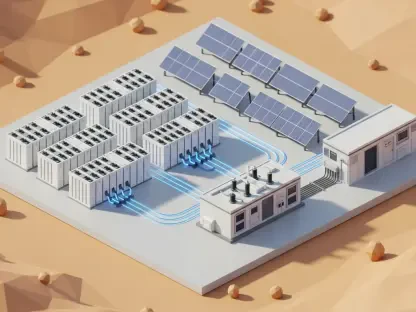

Further contributing to the supply-side concerns is the evolving situation in Venezuela, where the United States has begun to ease long-standing sanctions on the country’s energy sector. This policy change opens the door for new investments and the resumption of operations by international oil companies, creating a pathway for Venezuela’s considerable oil reserves to re-enter the global market in a more significant way. Although the process of reviving the nation’s dilapidated oil infrastructure will be slow and fraught with challenges, the long-term potential for increased production adds another layer of bearish sentiment to the supply outlook. The combination of a potential OPEC+ production hike and the gradual return of Venezuelan crude creates a powerful narrative of abundant future supply. This narrative serves as a formidable counterweight to demand-side optimism, forcing traders to price in the risk of a market surplus that could materialize later in the year and keep oil prices in a constrained range despite positive economic signals from major consumer nations.

Geopolitical Undercurrents and Market Sentiment

The Fading Risk Premium

The intricate dance of oil prices is also choreographed by geopolitical events, particularly in the Middle East. For a period, heightened tensions between the United States and Iran provided a floor for prices, with the market pricing in a risk premium to account for potential supply disruptions in the critical region. However, this support began to erode following comments that suggested a diplomatic pathway to a new agreement might be opening. The prospect of de-escalation, even if distant, was enough to cause a dip in prices as traders began to unwind some of the geopolitical risk premium that had been built into the market. Despite these diplomatic overtures, the underlying situation remains tense and unpredictable. Underscoring the continued volatility, the Pentagon confirmed the deployment of a second aircraft carrier to the Middle East, a move that serves as a stark reminder of the fragile security situation. Analysts estimate that a risk premium of between $5 and $7 per barrel is likely already embedded in current crude prices, reflecting the persistent threat of a conflict that could impact the flow of oil through vital maritime chokepoints.

A Market in Limbo

The confluence of these competing factors left the oil market in a state of delicate equilibrium. The positive U.S. economic data provided a clear, tangible reason for optimism about future demand, suggesting that the world’s largest economy could be on a path to stronger growth. At the same time, the potential for increased supply from both OPEC+ and other regions like Venezuela presented a compelling argument for a more bearish outlook. This standoff between bullish demand signals and bearish supply prospects created an environment where price movements were limited, and conviction was low. Geopolitical developments added a final layer of complexity, with the premium for Middle East risk fluctuating based on the latest headlines. The market’s struggle to find a clear direction reflected a broader uncertainty about the global economic recovery and the future production strategies of major oil-producing nations, a situation that left prices vulnerable to sudden shifts in sentiment driven by the next major economic report or geopolitical event.